Jeremy Stein Brings More Salt To the Fed's Table

An Important Maiden Speech and Venue

On October 11th 2012 Jeremy C. Stein, one of the latest additions to the Federal Reserve Board of Governors, made his maiden public speech. The venue chosen for this speech, provided a signal of the intentions and capabilities of Governor Stein.The Brookings Institution is synonymous with FDR and the creation of the New Deal. It is also synonymous with the Marshall Plan for Europe. Clearly, Governor Stein wished to allude to these two historic events to announce his arrival on the global stage.

The speech generally conformed to the principles that Chairman Bernanke opined; as his rationale for embarking on the latest Quantitative Easing programme. Stein however provided a slightly more granular analysis of the Fed's purchases of mortgage backed securities. His conclusion was that purchases of these securities would create greater bang for the QE Buck than the purchase of US Treasuries. He was also careful to opine that the risk of portfolio concentration in these securities, in both the Fed's balance sheet and the balance sheets of investors who followed rather than fought the Fed, would be something that needed careful scrutiny going forward. Having begun to elaborate on these risks, he quickly discounted them; by saying that greater regulation and oversight of holders of these securities, by the Fed, would be needed. The Fed therefore is the buyer of first (and last) resort and also the regulator; which sounds like an egregious conflict of interest that Governor Stein has overlooked.

It is not difficult to see the consequences of such a conflict, unintended or otherwise. A scenario can be generated in which the Fed owns all the mortgage backed securities outstanding; therefore forcing fixed income investors to buy US Treasuries, either because there is nothing else to buy, or because they become totally risk averse due to the Fed's strategy. Commercial banks, who currently own a great deal of mortgage debt, can therefore exchange it for less risky US Treasuries. The US banking sector is therefore de-risked.As a consequence, unintended or otherwise, the commercial banks end up monetizing the debt of the United States in the form of US Treasuries. This hypothetical scenario, generated by the conflicted Fed, has the positive externality effects of monetizing the US Federal Deficit and bailing out the US Banking System simultaneously. It is hard to believe that this is not part of a grand strategy to kill two birds with one stone; or that Governor Stein is not involved in the tactical execution of this plan.

What Governor Stein Brings to the Table

Governor Stein brings a unique skill set to the Fed. He also brings what is known as "Salt" to the table.

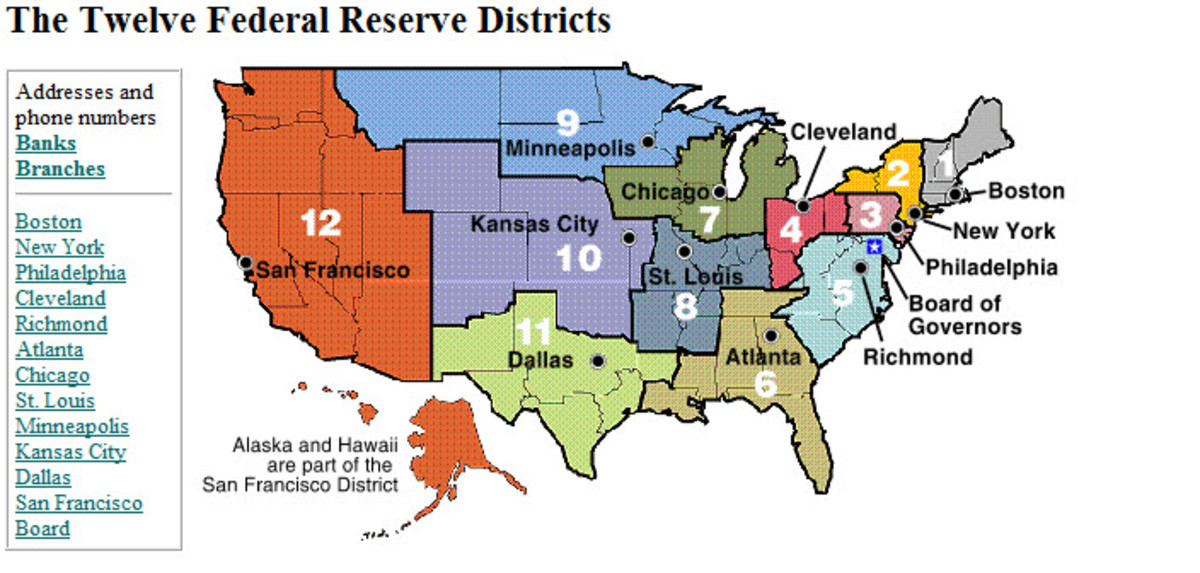

Beginning with the last quality first; the word "Salt" needs explaining. To do this, one must follow Governor Stein's career from academia to the Fed. He was an undergraduate at Princeton University; which is where Chairman Bernanke was a professor. Following in the footsteps of Chairman Bernanke, he then did his doctorate at MIT. Following MIT, he then became an assistant professor at Harvard Business School; and then moved on to MIT's Sloan School. In 2000, he joined Harvard University; Chairman Bernanke's old alma mater. One can conclude that Governor Stein has walked in the intellectual footsteps of Chairman Bernanke. These footsteps are indentified with what is known as the "Saltwater School of Economics", specifically located on the eastern seabord of the United States. The "Salt" that Governor Stein brings to the table, comes from the economic school of thought that is identified with Keynes.

Chairman Bernanke is the greatest student of the Great Depression; and its impacts on the New Deal and the Second World War that led to the Marshall Plan. It is hard not to hear history rhyming again in the current global economic environment. History also seems to be rhyming again; with the appointment of Governor Stein, as a kind of Bernanke "Mini Me".

Governor Stein has a unique skill set in capital markets and asset pricing; for which he received the Fama - DFA Prize. His winning paper was entitled "Breadth of ownership and stock returns";submitted in 2002. Eugene Fama, for whom the prize is named, is known as the founding father of the Efficient Market Hypothesis; and latterly for his criticism of the Capital Asset Pricing Model.

One begins to discern a pattern in the appointment of Governor Stein. Chairman Bernanke has made no secret of the fact that Quantitative Easing is targeted at asset prices. The performance of the equity market, since Quantitative Easing began, demonstrates this point. Chairman Bernanke needs someone who understands asset prices, especially equities, very well in order to execute Quantitative Easing with maximum effect and minimum risk. Governor Stein is clearly the man that Chairman Bernanke believes understands the job in hand. It doesn't hurt that Governor Stein also has the same "Salty" pedigree as Chairman Bernanke either.

Governor Stein therefore has the macroeconomic strategic background; and the micro-economic tactical skills. Bernanke was a student of the Depression; and this knowledge is what got him selected to become the Chairman of the Fed. Stein is a student of asset price behaviour; and this knowledge has qualified him to become the Fed's go to guy on the market impacts of Quantitative Easing.

Join the dots together, along with the little issue of the conflicted Fed and its consequences (unintended or otherwise) for US Treasuries and the Budget Deficit; and one can see a clear strategy evolving and being executed. Governor Stein will need the best of luck practically executing his academic theories in a capital markets environment, at the "Zero Bound", that the US Economy has never seen before.We wish him well.